When you pull your financial statements, what do you look at first? Chances are you go straight to the net profit line. Last week, in addition to the net profit number, I shared other aspects of your Profit and Loss report that you should be evaluating. This week let’s look at the Balance Sheet to understand the important ecommerce bookkeeping information in this report that you will want to drill into each month.

Breaking Down Your Ecommerce Balance Sheet

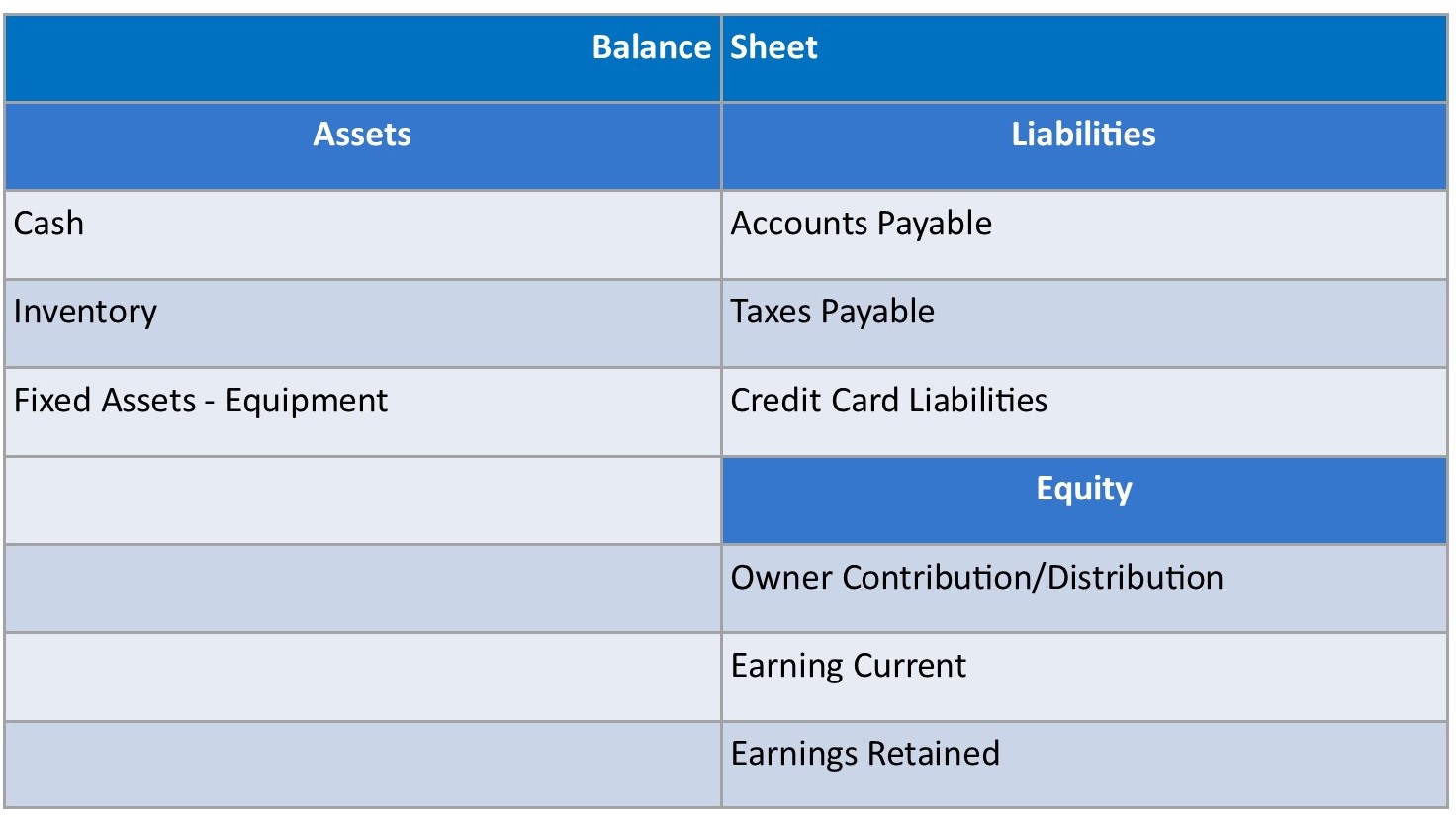

Many ecommerce entrepreneurs don’t spend much time on the balance sheet. As a business owner, it is an important report to understand and monitor. Let’s start with the big picture. Author Keith J. Cunningham in The Ultimate Blueprint for an Insanely Successful Business explains the Balance Sheet is the World Atlas, while the Profit and Loss Statement and the Cash Flow Statement are Street Maps. He describes the components of the balance sheet as: the left-hand side (Assets) is for “Things and stuff” and the right-hand side (Liabilities) is for “What you owe and own.” The accountants know that the balance sheet equation is Assets = Liabilities – Equity.

Your Cash Accounts

What are the main numbers on the balance sheet that you want to monitor each month? I recommend you run your balance sheet for the year to date and have it display by months. First, look at what is happening to your cash accounts. Are you growing your cash balances or are they dropping? A helpful chart to monitor this at a glance is the Cash on Hand Graph (below) that also displays high and low balances.

Your balance sheet by month will also allow you to see the trends not only with cash accounts but also your debts. Growing cash and reducing debts is a signal that you are effectively managing your assets. It should always be your goal to minimize the assets required to produce the maximum amount of revenue. The Liquidity Monitor Graph below helps you to understand the trend in the relationship between your current assets and current liabilities.

Your Inventory Accounts

The other important account to monitor is your inventory account balances. For ecommerce sellers, maximizing the return on inventory should be a key focus area. Is your product turning over quickly? Do you have stale inventory tying up your cash? Inventory is simply cash you can’t spend, so make sure it is being managed effectively. Ensure you have systems in place to track inventory appropriately and that you are tracking and attempting to reduce inventory days (the length of time your inventory sits on your shelf before it is sold) which subsequently increases your inventory turns.

Many of our clients are making down payments for inventory and paying balances as products ship. These products may be in transit for 60 days or more before they are available for sale. With money tied up in inventory, you want to carefully monitor those prepaid and in transit items to ensure you are making your inventory evaluations based on products in hand.

The Equity Section Tells the Story

Finally, the Equity section of the balance sheet incorporates your past year’s cumulative performance in the retained earnings accounts. If you have made owner contributions or taken distributions from your business, that will show up in the equity section of your balance sheet. The other account displaying here is the Net Earnings or Net Income from the current year. This information is the “bottom line” from your P&L and will change each month based on the performance of the business that month. You want to monitor your equity trend. As this grows over time, it means what you own in the business is growing.

Graphical Reporting for Great Visuals

With our new Progress Masters Service, we’ve been developing new reporting for our clients to give them deeper insights into their financials. We are using graphics to do trend analysis because a picture tells the story so much quicker, and in many cases, much clearer. What options do you have for visually monitoring your financials? If you find it challenging to review and digest the tabular data, then graphical reporting may be the answer for you. To learn more about Progress Masters, contact Bree@bookskeep.com. We start clients in the program every quarter and we’d love to add you to the waiting list.

Interested in Profit First?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits. Contact bookskeep today to learn more about ecommerce accounting.

FREE TRAINING – July 7th

If you are someone with a desire to be profitable and to grow your ecommerce business , then I want to invite you to my brand new FREE training: Profit Is A Habit.

Leave a Comment