In the past, I’ve discussed how to set up your Profit, Owner’s Comp, and Tax accounts using the Profit First method. But do you know how much to add to each account? Luckily, you don’t have to guess. You can use the Instant Profit Assessment instead.

Know the Real Numbers

Until now, I’ve only talked about all the great and rosy components that make up Profit First, and while those are absolutely real, the not-so-rosy pieces are real as well. The truth about many business owners is that they don’t know their real numbers, and, even if they are feeling the heat and have suspicions about their finances, they still don’t want to know. Often times I discover that the business owner is so unconcerned because they think that financial problems are temporary and will work themselves out in time. More often, people think if they “borrow money to buy better inventory,” their problems will be solved.

The best way to get your reality check is to compare your business with the benchmark numbers of a healthy business, but many times business owners aren’t willing to face the facts until they have no other choice. Looking at the numbers and making the changes is scary, but it’s the only way to create a healthy business.

How to Take the Instant Profit Assessment

If you want to get real and are brave enough to face the cash-eating monster, your first step is to take the Instant Profit Assessment. You will need to pull these items from your financials:

To begin, I’m going to show you how to complete your Instant Profit Assessment. Gather these items from your financial records*:

- Balance Sheet from December 2021 to June 30, 2022: Print this out by year. You want to see a column for Dec 2021 and a column for June 2022. If you can export this into an Excel spreadsheet, it will make it easier for you. You need to start with the June 30 account balances and subtract the Dec 31 account balances. The resulting difference will be used in our assessment.

- Profit and Loss Year to Date for June 30, 2022: Print this out year-to-date.

*Note: I am assuming a calendar year-end and cash books, or modified cash where Inventory purchases hit the balance sheet and entries are made to the P&L for COGS (Cost of Goods Sold). If your fiscal year-end is different, you need to adjust the dates so you can compare the prior year end numbers with the last completed month of the current year. Be sure the time period you choose for the P&L and the Balance Sheet is the same.

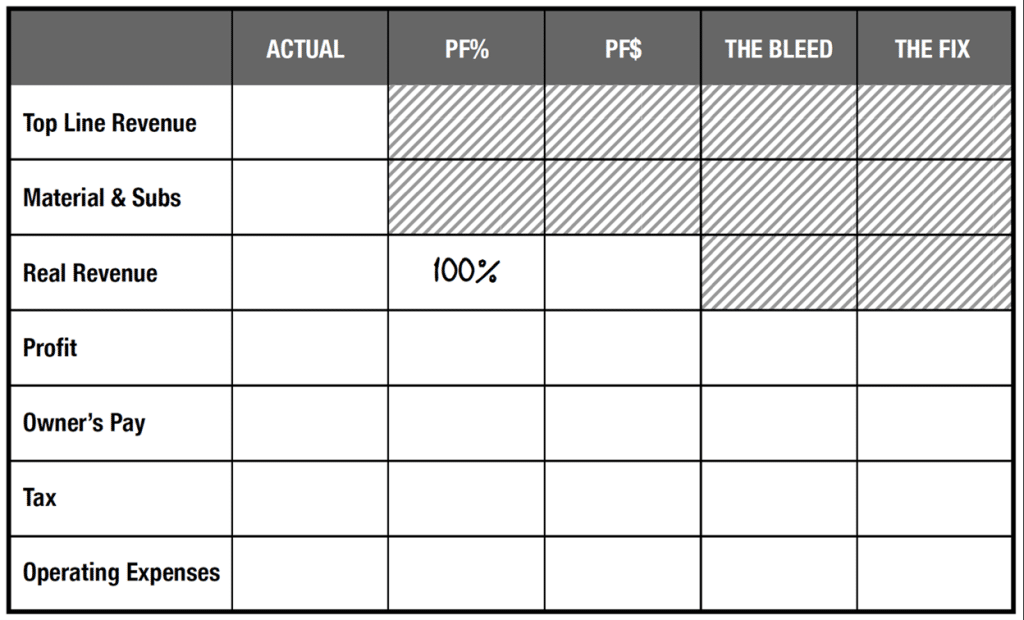

This is the Instant Assessment Form you will be completing.

Here is a description to help you derive each number you will need as you complete the chart.

Top Line Revenue. From Your P&L; this is the total revenue.

Material and Subs (Inventory). From your Balance Sheet worksheet; the different number for your inventory account between Dec and June. That number will be added to your COGS number on your P&L.

Real Revenue. This is Top Line Revenue minus Material & Subs.

Profit. Look at your Balance Sheet and take the difference number you calculated for your Cash Bank accounts. If there is more money in your bank now than at the end of the year, this will be a positive number; if there is less, this will be a negative number. Next, look at your liabilities. What you owe on credit cards, lines of credit, Amazon, or Kabbage loans must be considered. Take the difference number you calculated and subtract it from the number that you calculated for your bank accounts. The next step is the hard part, because if you pay off your credit cards each month, you may still have a negative Profit account number. Frequently, I see people that count on their future sales to pay their credit cards. This means they have negative real profit, even though they pay off their credit cards each month and the bottom line on their P&L is positive.

Owner’s Pay. You may find this in the salary number on your P&L or you may find it as an Owner Distribution on the Balance Sheet, or it could be both. If you are taking both, you can add the difference number you calculated for the Balance Sheet to the salary number from the P&L.

Tax. This is only for State and Federal income taxes – not sales tax or franchise tax; those stay in operating expenses. If you are paying estimated taxes, this should be found on your Balance Sheet. If you are recording estimated taxes on the P&L, just use that number.

Operating Expenses. Start with the Expense total from your P&L. Reduce the total by any Owner’s Pay or Taxes that are included in that number.

Once you have added all this information into the form, subtract Materials and Subs, Profit, Owner’s Pay, Tax, and Operating Expenses from Top Line Revenue. This number should equal zero or be close. If it doesn’t, then go back and double-check your numbers. Specifically, look at your Balance Sheet. Did you use the difference calculation? If you used your June year-end number, that will not give you a correct result. Check for an error in the signs when you make your calculations. Also, ensure that every Asset, Liability, and Owner Distribution/Contribution account that has changed in your Balance Sheet is represented in your calculations.

The final step is to get your Profit, Owner’s Comp, Tax, and Operating Expenses to a Percentage of Real Revenue. Take each number, i.e. Profit and divide by the Real Revenue, then multiply by 100 to get your percentage. Profit / Real Revenue * 100 = Profit First Percentage. Add this to your Table.

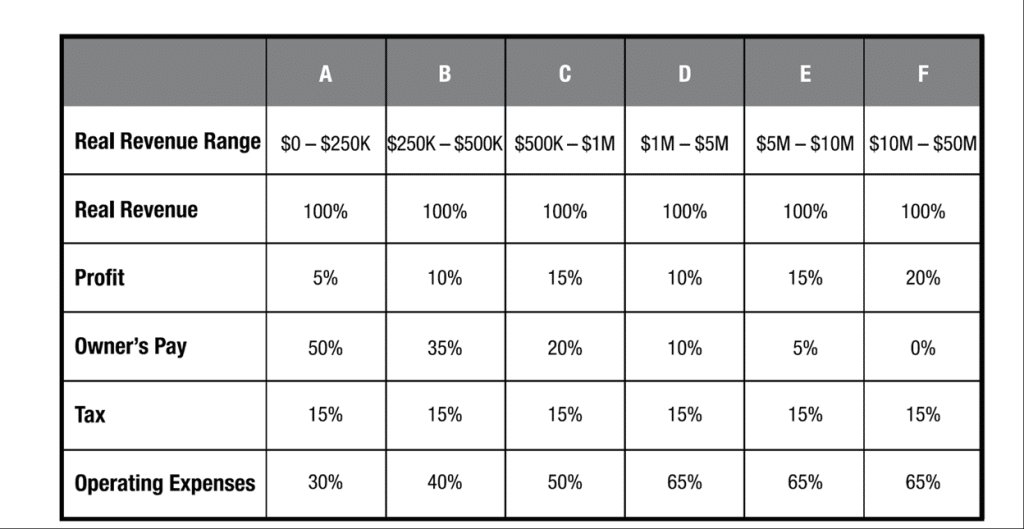

After your table is complete, you may still have a few blank rows. This might be because you aren’t paying yourself or your estimated taxes. You can compare your charge to the percentages of a healthy business. The chart that Mike Michalowicz presents in Profit First is below:

How do your numbers compare? Keep your head up if your numbers aren’t the best. Now that you know, you can work to fix it. If your problems are a bit more complicated and the numbers just aren’t working, don’t worry. This is a simple example due to limited space. If you are stuck, the Profit First book can provide you with much more detail. You can download the 5 core chapters here, or reach out to my team at bookskeep.com, and would love to help.

Make the Move to Improve

There are always ways to grow and get better. For now, ensure that your inventory and operating expenses are in separate bank accounts. If everything else is going to Operating Expenses, simply start putting 1% in your Profit Account.

If your numbers turn out to be pretty good, and your cash flow is healthy, you can begin funding each of the accounts at the current percentage on your chart and add 2% to your Profit account. Reduce your Operating Expense account by the 2%. Be sure to closely monitor your accounts in the beginning. As with any new system, it may take some dialing in.

This Instant Assessment is great for giving you a quick overhead view. The monthly assessment allows us to see things at ground level. Now you have the tools to get started, so get real with your numbers today!

Interested in Profit First?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Leave a Comment