As I sit here in the middle of February looking back, it’s obvious that we, of course, spent most of January completing financial statements for our clients. Year-end isn’t much different for us than month-end because we expect to deliver accuracy year-round. However, this time it’s crucial that we have inventory right because of tax implications. Of course, there are always challenges.

If you got your inventory numbers accurate right off the bat without having to make even the smallest of tweaks this year, let me know your secret. If you didn’t, and like the rest of us you had some sort of struggle with getting your inventory right for this year-end, or if inventory is just mysterious to you in general, let’s talk about some steps that can help you learn to love those inventory numbers. After all, it is Valentine’s Day, and if your inventory and cost of goods sold (COGS) have a rocky relationship, your profitability is probably headed for heartbreak. Now, let’s see the love language of inventory.

Inventory Love Language

Some time ago, I had a talk with my friend and fellow accountant, Michelle. As I explained how much trouble several of our new clients were having with inventory management, she laughed and told me that she knew where to find the inventory answers in her practice. This excited me, and I leaned forward in my chair, waiting to hear this golden nugget of information. Then she told me that all the answers to those inventory questions were written on the ceiling of her office. I sat back confused and asked her what in the world she meant. She said, “When I ask clients questions about inventory, they always look up at the ceiling and then give me their answer.” So I came away with a great anecdote, but no magic inventory trick.

Instead, we do have a best practice that we always recommend when it comes to recording monthly COGS based on the products sold. It will capture most of your activity correctly and we recommend you also do a quarterly inventory true-up as well. If you take a complete inventory account at the end of every quarter and apply the product value that you also use to value your COGS, any discrepancy found will need to be a true-up adjustment to Inventory and COGS every quarter.

Where’s the Break-Up?

There are several reasons that can cause your COGS to disconnect, like lost, damaged, or stolen products. There may also be products that were prepaid for out-of-inventory but haven’t come in yet. You might have special terms with a vendor and have received products that have not yet been paid for.

As your business grows and things get more complicated, you’ll want to have a good understanding of all the moving pieces to be sure that your financial records are accurate. There’s nothing more heartbreaking than working all year and thinking your profitability is in one place, just to do a year-end inventory adjustment and wipe it all away. Or another situation where you write up your inventory and reduce your COGS to show an increase in profit, only to be blindsided by a bigger tax burden that you weren’t ready for.

Make a Connection

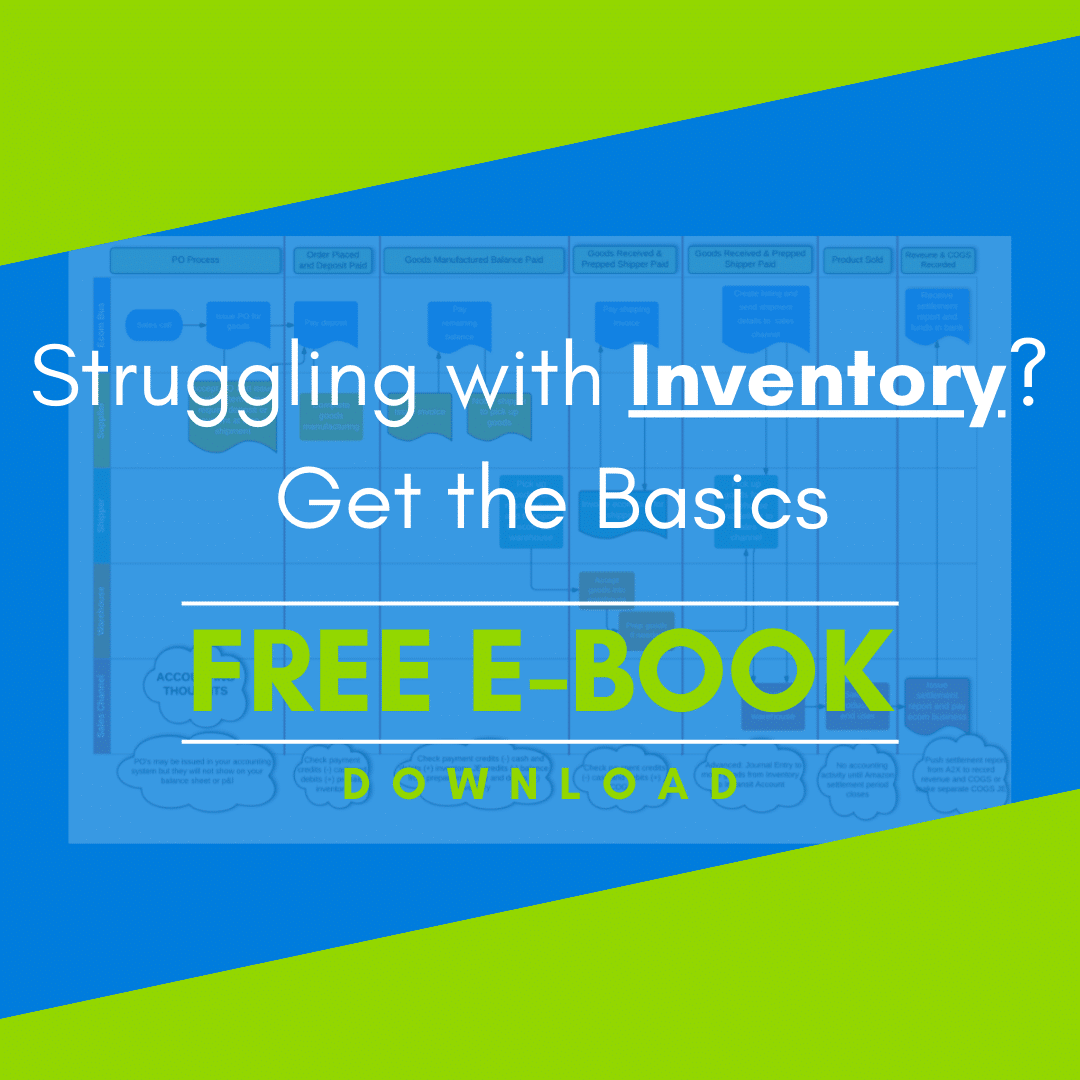

The connection is one of the most important pieces in the relationship, and putting good inventory practices into place is the best way to make that happen. You’ll have solid data all year when it’s time to make those operating decisions, and tax time will also be a breeze just like the end of every quarter. If you’re ready to spark a connection between inventory and your books, download our free Inventory Basics- What Every Ecommerce Seller Needs to Know and we’ll walk you through six of the most common concerns we hear and how to take care of them!

- How inventory works on the Balance Sheet and the P&L

- What needs to be included in unit cost calculations

- What should be expensed directly to the P&L

- Best practices for tracking inventory on a spreadsheet

- Considerations for using an inventory software tool

- Advanced Inventory Issues

Now that you can speak the inventory language of love, you should be all set to create a strong relationship that will stand the test of time! Download your free guide and get started today!

Interested in Profit First?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Do you know about Cyndi’s new book?

Motherhood, Apple Pie, and all that Happy Horseshit

“You’re about to discover the recipe for successful momma entrepreneurs.”

Business is Personal

As a Mom, you can have it all and it’s better when you do. Using your personal values to create the business of your dreams. By the end of this book you’ll be confident in designing a business that supports your family and yourself. Order Now!

Leave a Comment