Anyone who has ever needed to set up a bank account knows what a hassle it can be. Between having to make a trip to the bank, waiting out the long lines, and filling out paperwork, one small account can take a huge chunk of time and energy. If you’re trying to set up accounts following the Profit First model, this is especially true and sometimes causes trouble at the bank.

Relay has changed the game! At QB Connect 2019, I met Yoseph West from Relay, and I was thrilled to discover an online banking service tailored to Profit First for ecommerce sellers. In a recent conversation with Yoseph, I gathered valuable background information and asked specific questions. Here’s what I learned.

What is Relay?

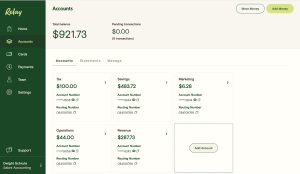

Relay is a no-fee online banking and money management platform for small businesses. It is the online partner of Evolve Bank & Trust, located in Tennessee. This bank was established in 1925 and offers FDIC insured accounts. Here’s a quick rundown of just a few of the great features offered by Relay:

- Accounts can be set up completely online in as little as ten minutes and synced to platforms like Amazon and Shopify;

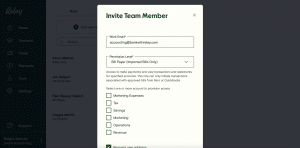

- Collaboration is made extremely easy with the partner portal that allows clients to give access to your virtual bookkeepers without giving them personal login information or full access to an account;

- This service also provides audit trails to keep both clients and accountants in the know about transactions; and

- Account owners have the option to easily create virtual and physical debit cards. Cards can be issued to the business or the employee and can be used to control team spending.

How does Relay work with software like QBO and Xero?

Yoseph: Relay is actually integrated with both, and bookkeepers can manage the connection on behalf of their clients, which is nice. You can log in with your own Relay credentials through the partner portal and you can say, ‘Okay I want this Client A account to be hooked up to QBO.’ We’re one of fifteen U.S. banks that has a direct bank feed integration. The Xero API is a little more flexible, and so we’re able to actually populate a payee name. It’s a little bit more organized, but we send the same information to both. You can still do a lot of the same automation because of the quality of data that’s coming across.

Can Relay be used to pay bills online?

Yoseph: Relay can be used to do bill pay online. Our integration with QuickBooks and Xero allows clients to be able to pull in unpaid bills. What we hear is that small business owners really just want to run their bill pay through their bank accounts. They don’t want to use an external tool, so we thought it made a lot of sense to move that tool into Relay. We’re also working towards having approval workflows.

What does a person need to set up a bank account?

Yoseph: The documents required vary depending on the type of entity, but in general you’ll need to provide a tax ID, government ID, and personal address for a sole proprietorship. For an LLC, we’ll need the articles of organization, an operating agreement, an EIN verification letter, a government ID, and a social security number.

Does a foreign company need to be established in the U.S. to create accounts?

Yoseph: Yes, foreign companies do need to have an entity established in the United States.

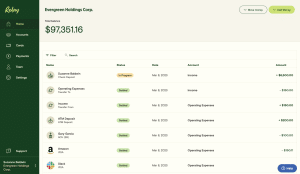

How can users go about setting up multiple accounts?

Yoseph: When an account is live, there will be an accounts tab. From there, you can add an account, name it, and decide who gets access to it. Then the account is immediately established and available. There is a limit of ten accounts, however.

How does Relay compare with Mercury Bank?

Yoseph: Relay focuses on having that channel between for bookkeepers to make the account and the client’s life easier. Relay also flows with the Profit First method very easily between setting up the accounts, making transfers, and being able to see an audit trail. We also have a mobile app for iPhone and Android, which Mercury Bank does not have at present.

For a full breakdown, you can check out our Relay vs Mercury comparison blog post here.

How do you handle transfers to foreign banks?

Yoseph: We do have international wires, but it can be expensive; around $50. I recommend clients integrate with a system like TransferWise, which Relay can be added to as a funding source.

How does this system make money if it’s a no-fee service?

Yoseph: We are largely funded by a percentage of merchant fees that are paid when account owners use our Relay debit cards.

What protections do you offer for Relay debit cards?

Yoseph: We do have a fraud protection system that tracks client history and will notice if there is a foreign or unusual charge. Relay allows you to set controls and limits on the cards as well and enables you to block strange charges. If you do happen to have a fraudulent charge made, as long as you make a report within five days of that charge, you will be refunded for it.

I am very excited to share the Relay system, especially knowing how well it can work for Profit First ecommerce businesses. Having a bank that is reliable and easily accessible is the first step in financial success, and Relay definitely checks all the boxes! You can check it out here!

Dear

Does Amazon Fba Accept Raley Business Bank Account?

Best

Jan

Yes! Many of our clients who are Amazon FBA sellers utilize Relay Bank!