Level Up Your Business with SmartCFO

Get the guidance, support and structure you need to make your business work for you.

- Identify Blindspots

- Resolve Bottlenecks

- Discover Untapped Opportunities

Ecommerce Business Growth is Complex

As an ecommerce business owner, you recognize the complexities of the business model. Making critical decisions about supplier relationships, inventory forecasting, and advertising campaigns can be overwhelming. Our SmartCFO service was developed with your specific challenges and needs in mind.

SmartCFOs Understand Small Business

You need a SmartCFO that understands small business challenges and the limited time and money available to solve them. Traditionally, a corporate CFO devours mountains of paper, and sets budgets for people and projects for organizations with over $50 million in revenue. A SmartCFO understands that your problems have strong ties to your personal goals and finances.

Track Progress with Clarity

Measuring the effectiveness of your initiatives is essential to ensure they’re delivering the expected value and driving progress toward financial goals. That’s why we track key performance indicators (KPIs) such as cash flow, profit margins, and cost savings to ensure we’re making progress on your goals.

Ready to transform your ecommerce business and

make your business work for you?

Get Started in Three Easy Steps

Click The Button Below and Schedule Your Call

Discuss Your Specific Challenges and Goals

Choose the Perfect Solution For Your Business

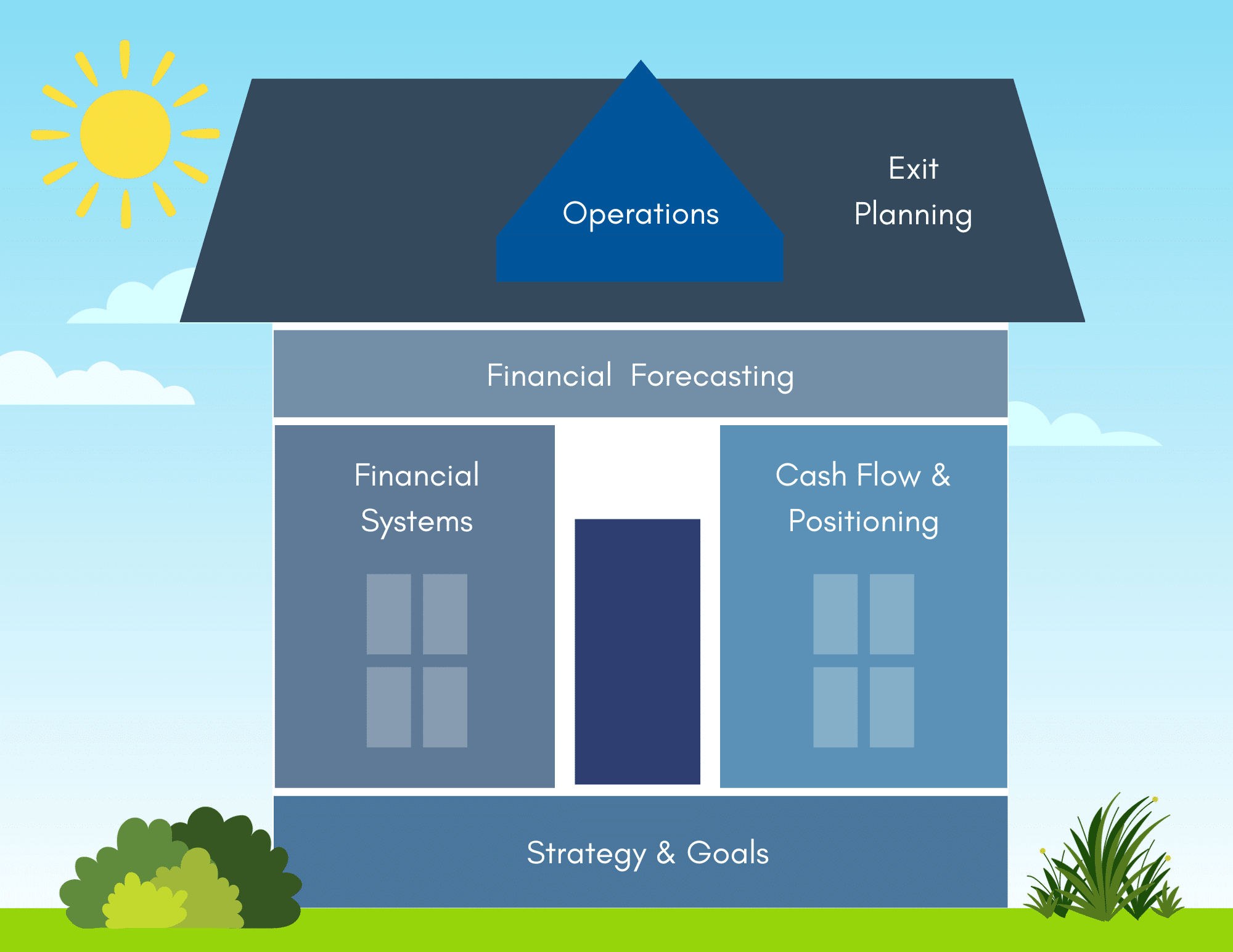

The Six Main Elements of Ecommerce Business Success

Strategy & Goals

Your business should support your life. That’s why our mission is to help clients increase profits, reduce debt, and grow and/or sell.

Financial Systems

By understanding the key numbers in your business, you can cut through the noise and focus on what the numbers are telling you.

Cashflow Positioning

Understanding how individual product sales contribute to cash intake and how expenses can either drain or add a nice return is vital.

Financial Forecasting

At bookskeep we use multiple tools to forecast financial results and help clients review the profitability of future product ideas.

Operations

Once you have your cash flow humming, we can guide you to tackle operational issues.

Exit Planning

Having confidence in your numbers sets you up to get the price you set because you are prepared.

Take the short Business Performance SmartAssessment to see

how your business is performing in each of these areas.

SmartCFO Blueprint

Clarity and focus on your goals and how to measure success

Books that help you make better management and cashflow decisions

Profit First Assessment – to predict issues BEFORE they happen

Get expenses under control and start giving yourself a paycheck

Learn to read your financials for warning signs of trouble

Have a rainy-day fund for unexpected events

Identify and manage to the KPI’s that increase profit and security

Get paid consistently from your business

Be clear on what product and marketing actions are most profitable

Sleep soundly with clear financial forecasts

Hire help and get back your time

Get back to fun by removing the stress and debt and uncertainty

Maximize profitability with intentional inventory and advertising management

Maximize Profit First to keep your business healthy